Q3 2025 San Francisco Multifamily Report

The San Francisco multifamily market continued its recovery trajectory through the third quarter of 2025, supported by improving fundamentals and strengthening investor confidence.

Key market indicators reflect positive momentum:

• Sales velocity remained stable, with approximately 50% of listed properties going under contract during the quarter.

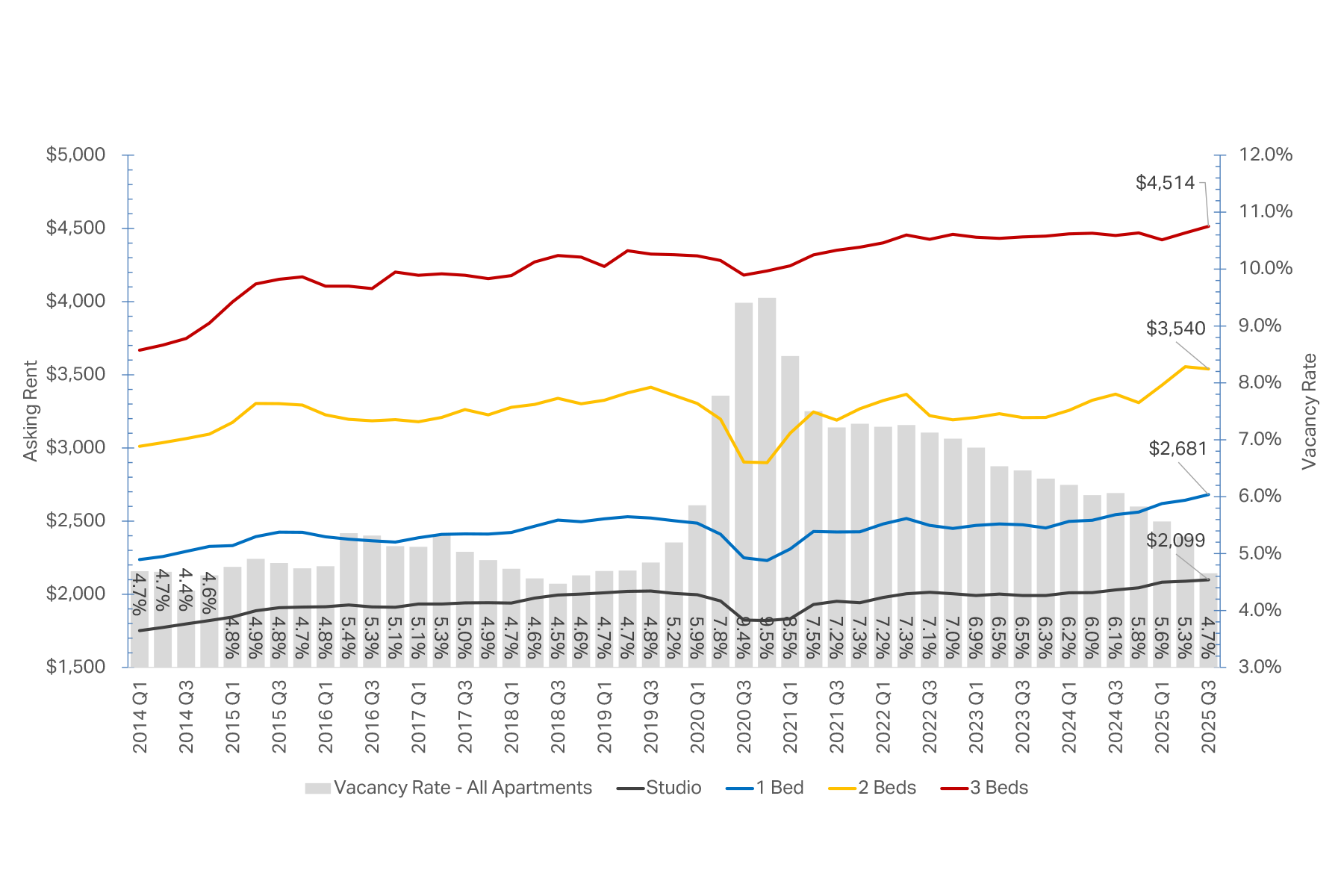

• Effective rents posted continued growth quarter-over-quarter. • Vacancy declined further to 4.7%, the lowest level recorded since Q1 2019.

• Cap rates continued to compress, with the citywide average now at 5.85%. Prime neighborhoods such as Marina and Pacific Heights achieved a marketlow average of 4.85%.

First hand, LL CRE observed heightened competition for well-located assets, with multiple offers and “best-and-final” rounds becoming increasingly common.

Looking ahead, LL CRE maintains a constructive outlook for the San Francisco multifamily sector and anticipates slow, but steady sustainable improvement in transaction velocity and pricing through the coming quarters.

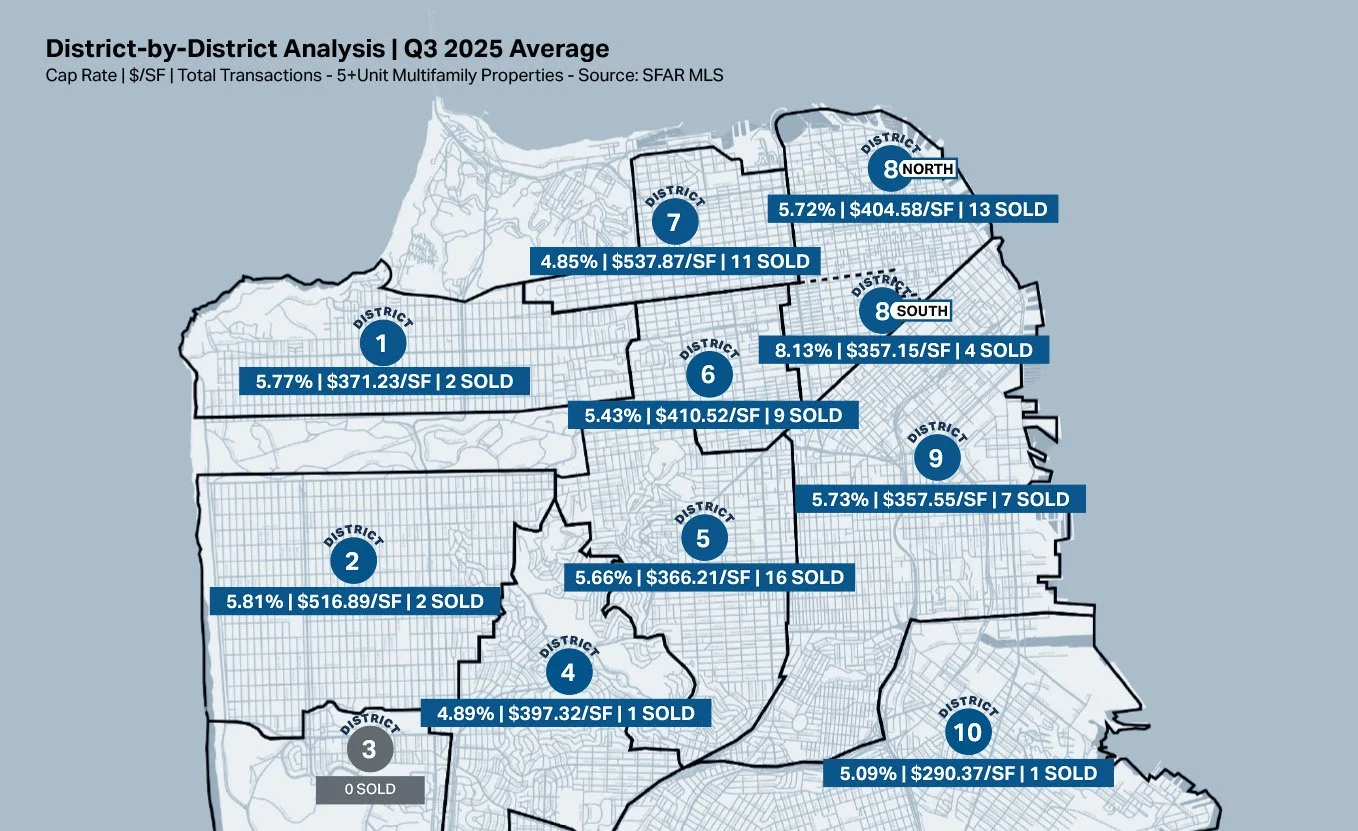

District-by-District Analysis | Q3 2025 Average/Total

Cap Rate | $/SF | Total Transactions - 5+Unit Multifamily Properties - Source: SFAR MLS

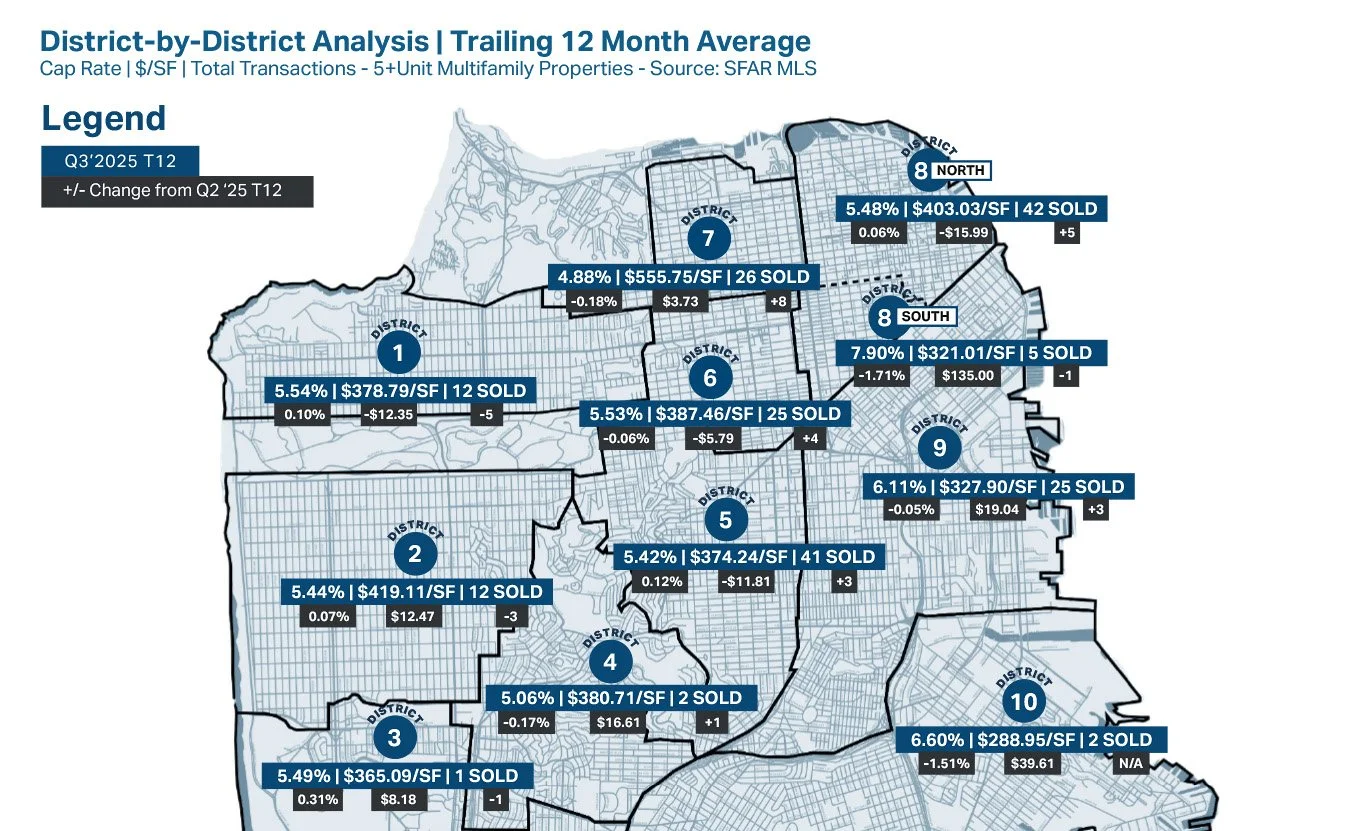

District-by-District Analysis | Trailing Twelve Month Average/Total

Cap Rate | $/SF | Total Transactions - 5+Unit Multifamily Properties - Source: SFAR MLS

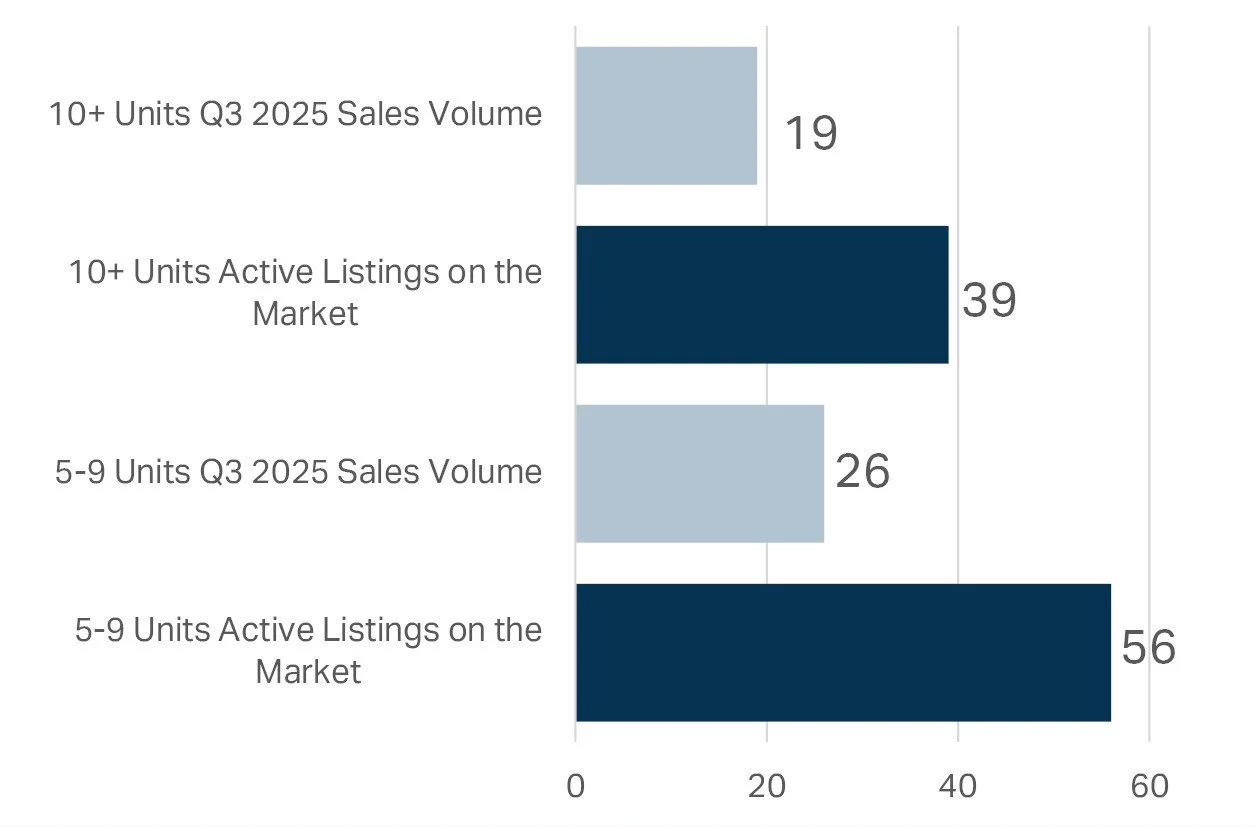

Transaction Volume and Active Listings

5+ Unit Properties - Sales Volume

5+ Unit Properties - Average $/SF | Cap Rate | GRM

Multifamily Vacancy Rate & Average Asking Rents

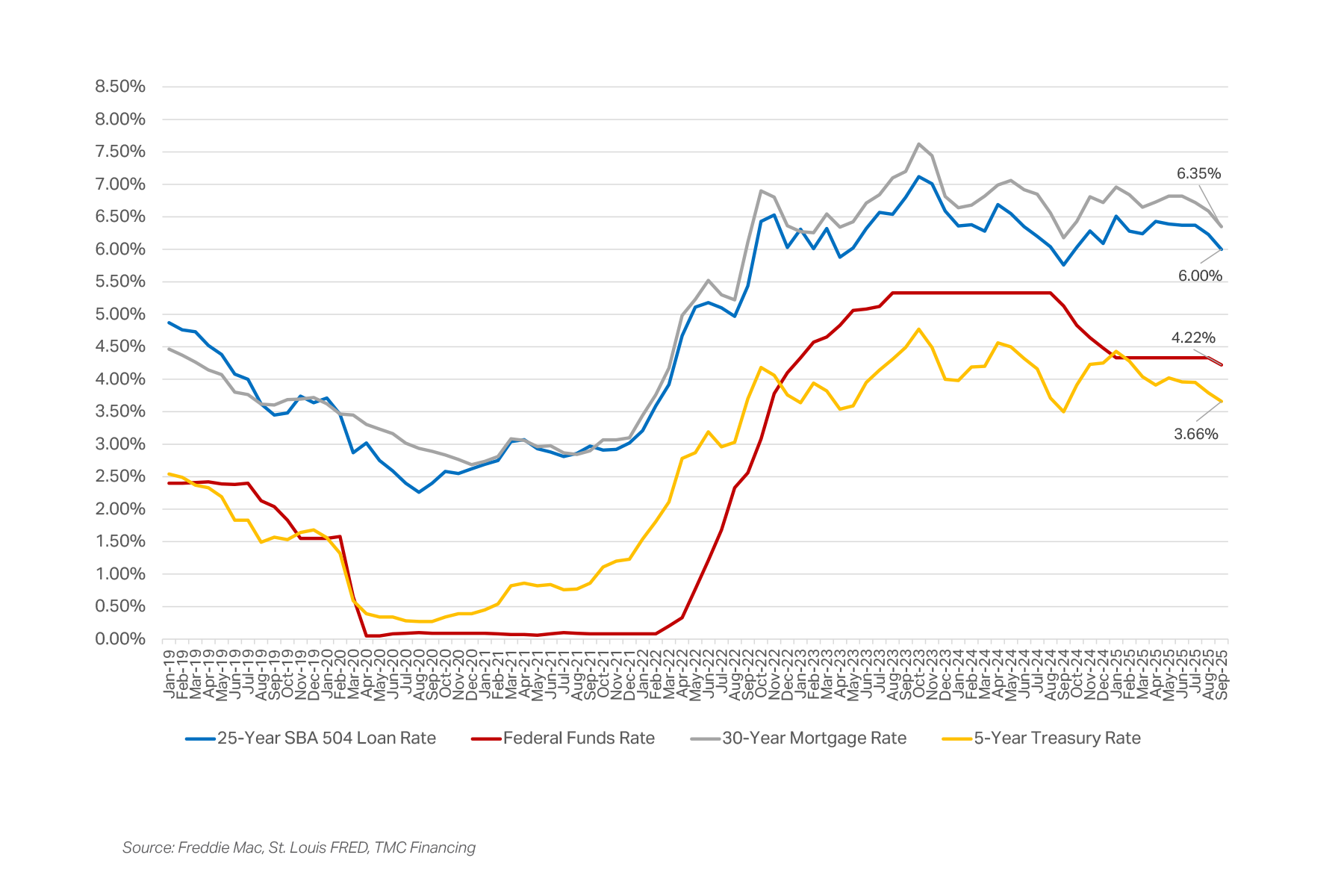

Federal Funds Rate, 30-Year Mortgage Rate, 5-Year Treasury, and 25-Year SBA504 Loan Rate

This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass and LL CRE Group disclaim any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass/ LL CRE Group does not provide such advice. All opinions are subject to change without notice. Compass and LL CRE Group makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

Free Broker Opinion of Value

Want to Know What Your Property Is Worth in Today’s Market?

Market conditions have shifted in the last year. If you're wondering how your asset stacks up in today’s environment, we’re happy to provide a complimentary Broker Opinion of Value tailored to your property’s unique characteristics.

Contact us for more market information or multifamily investment portfolio consultation

Brian Leung

Principal

Lic. 01203473

415 278 7838

Brian@LL-CRE.com

Jeremy Lee

Principal

Lic. 01951309

415 988 9719

Jeremy@LL-CRE.com

Carla Pecoraro

Associate

Lic. 02019669

415 312 8901

Carla@LL-CRE.com

Chris Palomarez

Associate

Lic. 02260779

650 703 2821

CP@LL-CRE.com